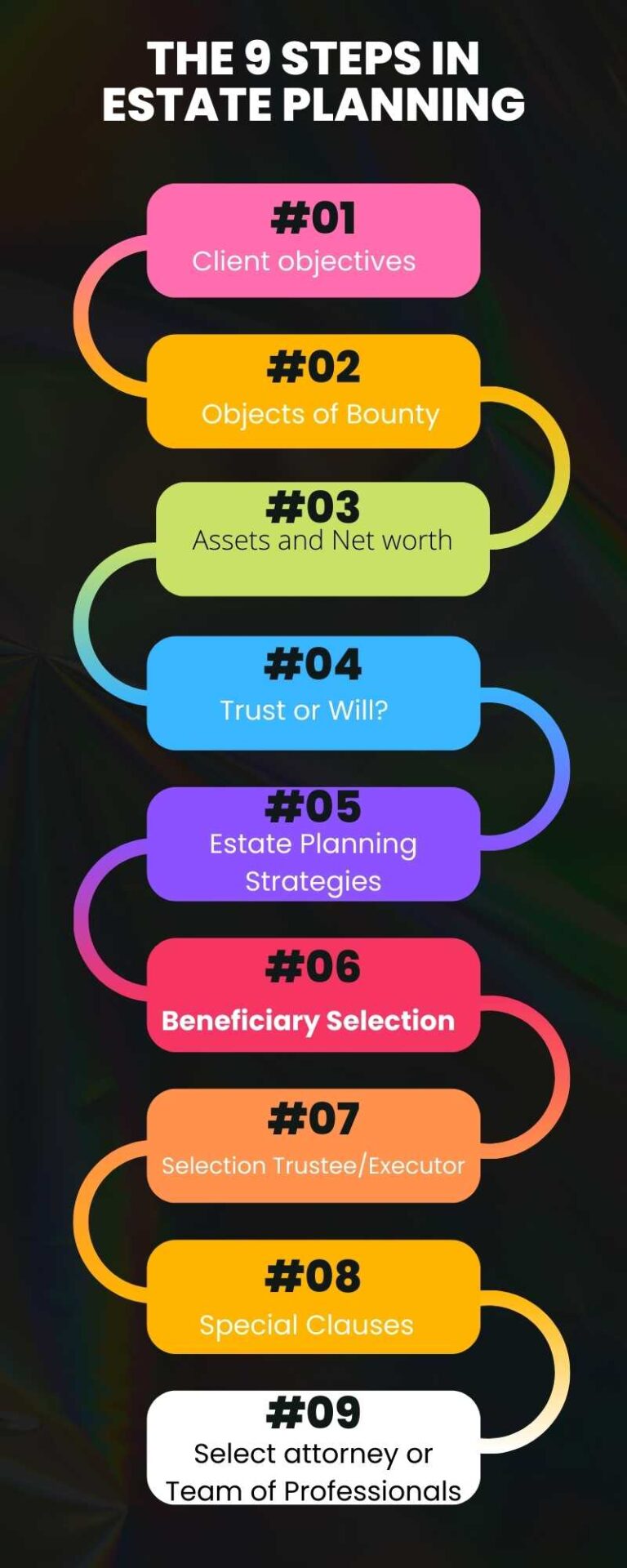

Estate Planning: 9 Critical Steps

Estate Planning involves 9 Critical Steps:

Step #1: Define Your Objectives.

Estate planning involves having happen what you want to have happen. The starting point is to define your objectives. Once that is done, there are 8 other steps to complete an estate plan. Estate planning is not “cookie cutter” with “one size fits all.” It is your estate and your money. You do not have to have your estate distributed the way “most people do.” ….. Unless that happens to be what you want!

Step #2: Delineate Your “family.”

Your “family” can mean the traditional family unit, i.e. your children and/or grandchildren, OR it can be a non-traditional family unit.

Some have no children. Others are estranged from some or all of their biological family members. Some persons want a portion — or even all — of their estate to go to charity. Others want a portion or even all of their estate to go to a friend.

The estate planning term is “objects of bounty.” The “objects of bounty” are who you want to benefit from your estate, if heaven forbid, something happened to you. It means the persons you feel closest to, which can be traditional or nontraditional family members, charities or friends. Your estate, your money, ……. have it go to whomever you want.

Step #3: Examine Your assets and net worth.

The assets and net worth you have is an important element in the planning process. Estates that are large enough to be subject to estate taxes should look at minimizing estate taxes. Some assets can have special problems or opportunities, and that should be considered in the planning process. A list or schedule of your assets, liabilities and net worth is helpful in the estate planning process.

Step #4: Decide between a Trust or a Last Will and Testament.

An Estate Plan can use either a “simple Will” (Last Will and Testament) OR a Trust as the fundamental estate planning document. The decision between the two involves a number of considerations.

Step #5: Consider Estate Planning Strategies.

…… But what kind of Trust? There are many kinds of trusts. Each has different requirements and different strategic objectives. The point is not a list of different kinds of trusts, instead the point is to review which estate planning strategies align with your own objectives. Estate planning strategies naturally lead into different kinds of trust that can accomplish your own personal objectives.

Step #6: Decide who YOU want to be the Beneficiary.

Clients should consider both Primary beneficiaries and Secondary beneficiaries:

A) Selection of Primary Beneficiaries.

Successful Estate Planning involves “having happen what you want to have happen.” Each client decides what is right for their situation and their wishes.

Some clients name children equally, other clients do not choose to distribute equally. Some clients have no children, and choose particular charities as their beneficiaries. Some clients, similar to Warren Buffet and Bill Gates, have children but nevertheless select charities as their beneficiaries.

Some clients choose a friend for part or all of their estate.

Naturally, a spouse is often the first choice, but not always. Note that there are some limitations on your ability to disinherit a spouse; although, there is not requirement under Florida law to leave any portion of your estate or trust to your own children, grandchildren, or other relatives.

The bottom line is that it is your choice.

B) Selection of Secondary Beneficiaries.

It is a good idea to try to always have “contingent” or “secondary” beneficiaries. If your primary beneficiary predeceases you, you will then have the contingency covered in advance. The contingent beneficiary that you name can be the primary beneficiary’s descendants, the other primary beneficiaries, or some other person or charity entirely.

It is true that you could skip the naming of contingent beneficiaries, and only name them if the primary beneficiaries predecease.

However, there is a disadvantage to waiting. If the predecease happens when you are disabled, incompetent, or distracted, the necessary update may never be made.

If you name a contingent beneficiary now, there will be no extra expense, time or trouble, or any effort to later name the contingent beneficiary. And if you change your mind at a later date, when the primary beneficiary predeceases, you can always then do an amendment to your estate plan.

Step #7: Decide who is to be the Successor Trustee, Executor, and POA Agent.

A) Primary person named to administer your estate or trust. The decision on who to put in charge of administering the estate and/or trust is a critical step in the process. Some of the available choices are: i) all the beneficiaries jointly, ii) one or more of the beneficiaries, iii) a commercial trustee, or iv) a trusted relative or friend who is not a beneficiary.

B) A “Backup” name to administer the estate or trust. Like the naming of secondary beneficiaries discussed in the previous step, clients should also name “backup” persons to administer the estate or trust. If the primary person named is a trust company, no “backup” is needed, as trust companies don’t die (and even when if a bank fails, the trust department is separate from the bank and doesn’t fail).

Step #8: Consider Special Planning Considerations.

There are many special issues and considerations that arise in estate planning. You need to identify and deal with any such special issues that apply to the your special situation. These extra issues are very specific to each client.

Step #9: Assemble the Professionals for the Estate Planning Team.

The components of your estate planning team are very variable, depending upon the particular client. If you opt for a “Simple Will,” perhaps you will only need an estate planning attorney.

A) Choice of Attorney. Be aware that there is a wide variety in experience, qualifications and percentage of time spent by attorneys in estate planning.

B) Commercial Trust companies. You are not obligated to choose a Commercial Trust company, you can choose your own family members, or a trusted friend (for Wills a trusted friend must be a Florida resident).

C) CPA or Accountant. You may wish to involve your CPA or Accountant.

D) Financial Planner. If you already has a financial planner, you should consider involving the financial planner or broker in the estate planning process.

CONCLUSION

Completing the 9 critical steps is a strategic path to both a well planned estate and to peace of mind.

To find out more about estate planning strategies click here:

To find out more about deciding between a Trust and a Will:

To find out more about different Trust Varieties:

To find out more about Estate Tax Planning: